emerging markets, and the relationship between gdp and stock market returns

There's a pretty common belief that GDP growth is correlated with stock market returns. Most of the time, this belief or assumption is implicit, and manifests itself in the form of the statements like: "Country X is growing 7% a year, we should invest in Country X." Sometimes this can assumption reveals itself in entire asset allocation strategies: "Emerging markets will grow faster than developed markets, we should invest in emerging markets."

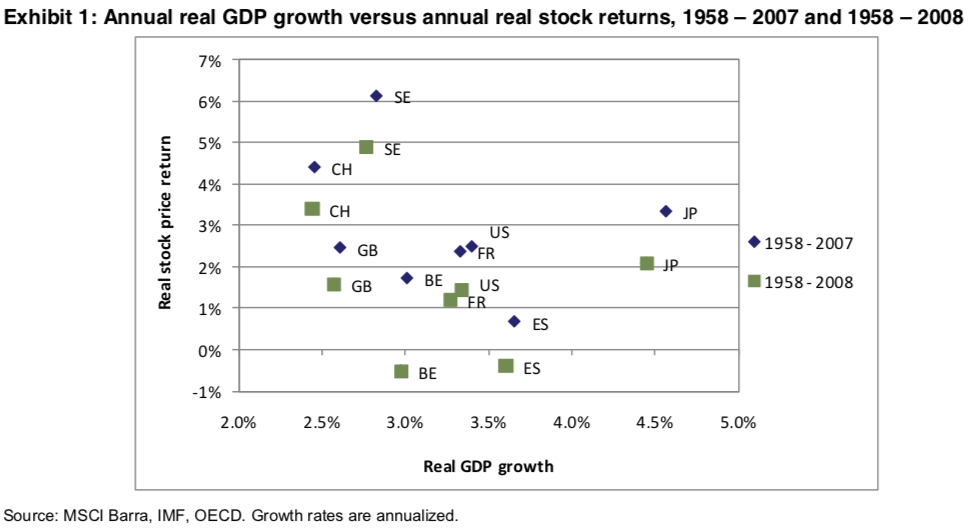

If you look at the numbers, though, you'd quickly be disabused of that notions. Frankly, lots of studies have been done on the relationship between GDP growth and asset price returns, and the relationship is spotty at best. In some cases, the GDP growth has been negatively correlated with stock market returns, the exact opposite of what you'd expect.

Don't take it from me, though - read the MSCI study from 2010, or the Northern Trust study from 2016. In a rather extreme case, the NT study notes that "the DMS researchers found a modest negative correlation between real (inflation-adjusted) equity returns and per capita GDP growth, and they found a modest positive correlation between real equity returns and aggregate GDP growth. The results were mixed and the evidence linking equity returns to GDP growth was weak, surprising many investors and economists."

Better yet, here's a picture, in case you aren't convinced:

Why doesn't the linkage work? I can't speak for developed markets, but here's my thoughts about this from the EM perspective. If you think about it, when a country shows strong economic growth, the companies best-positioned to capture the profit share of that growth are often multi-nationals. As a simple example, if you get a bonus, do you drink two local coffees? Or are you more likely to treat yourself to a Starbucks (or other imported) latte?

Another reason why the relationship doesn't exist could be that EM stock markets are particularly shallow. Beyond the usual coterie of banks, developers, telcos and commodities, many of the better quality business that could tap on domestic consumption remain in private hands.

Finally, shareholder protections for minority investors in EMs can be pretty iffy. EM companies can be rife with corruption and governance issues. Even if there's strong growth, profits can leak through many holes in the bucket before reaching shareholders.

There is a class of exceptions to this. In some of the larger emerging markets like Brazil, Russia and China, the large population base means that quality companies catering to domestic populations do occasionally emerge. Some examples include Stone, Totvs, MercadoLibre (Brazil/LatAm), Yandex (Russia), Tencent, Alibaba and Meituan (China). These companies probably merit a more in-depth discussion at another time.

Why do people keep peddling the misconception that GDP growth leads to better stock market returns? It's usually some combination of self-interest and self-delusion. It's really boring to tell people to keep on investing in Nike, Microsoft and Google. And that definitely doesn't attract any funds for EM managers!